Colgate India Intensifies Marketing and Automation Efforts

Colgate-Palmolive India is ramping up its brand-building initiatives and leveraging automation to optimize operations amid a dynamic economic landscape. In fiscal year 2025 (FY25), the company boosted its advertising and promotional expenditures to Rs 822.4 crore, marking a 7% increase from the Rs 760.4 crore invested in FY24. This strategic move is aimed at driving innovation, expanding household penetration, and strengthening overall brand health.

Managing Director and Chief Executive Officer Prabha Narasimhan emphasized the importance of a tailored approach to the Indian market. Speaking at the Storyboard18 Global Pioneers Summit, she said, “India is fascinating. You can’t average India—it’s like averaging the depth of a river. So we design for cohorts across the pyramid.” This philosophy underpins Colgate’s diverse product offerings, from affordable ₹10 packs to premium solutions for gum care and whitening, all aligned with principles of quality and sustainability.

Digital and Automation Drive Efficiency

Colgate is increasingly turning to automation to streamline its operations and rein in costs. According to the company’s FY25 annual report, automation is playing a pivotal role in optimizing media spend and promotion planning. This allows the company to reallocate resources toward high-impact initiatives while maintaining operational efficiency.

“Colgate is optimizing media spending and promotion planning, and saving costs through automation,” Narasimhan noted in the report. The integration of digital technologies is not just a cost-saving measure but also a strategic enabler of agility and precision in the marketplace.

Robust Financial Performance

Colgate India reported a strong financial performance in FY25. The company’s net profit after tax surged by 147% over the last decade, climbing from Rs 581.7 crore in FY16 to Rs 1,436.81 crore in FY25. Its revenue from operations reached Rs 6,040 crore, with an 8.5% year-on-year increase in profit after tax.

The company’s market capitalization currently stands at Rs 64,626.51 crore on the Bombay Stock Exchange, reinforcing its strong position within the Indian fast-moving consumer goods (FMCG) sector.

India: A Strategic Growth Engine

Colgate-Palmolive views India as a crucial growth engine within its global portfolio. Narasimhan highlighted the company’s tiered approach to the Indian market, focusing on segmentation by geography, income level, and consumer needs. “Our ability to win lies in our tiered approach, sharpening focus by segment, geography, and price point,” she stated.

For FY26, the company plans to further enhance premiumization through science-backed innovation. This includes leveraging artificial intelligence, data analytics, and other digital tools to stay ahead of consumer trends and market shifts.

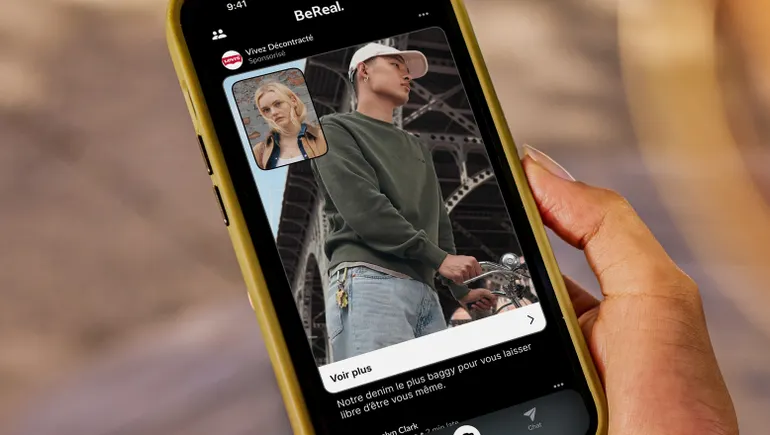

Expanding E-commerce and Omnichannel Presence

E-commerce has become an increasingly important sales channel for Colgate India. In FY25, digital commerce accounted for over 19% of the company’s overall business. This growth reflects a broader trend of digital adoption and changing consumer behaviors in the Indian market.

Narasimhan underscored the company’s commitment to omnichannel strategies, stating, “We are committed to building and nurturing both the Colgate and Palmolive brands, ensuring a deeper emotional connect and stronger recall. This includes sustained high investment in advertising and omnichannel media.”

Outlook for FY26

Looking ahead to FY26, Colgate India has outlined a strategic roadmap centered on large-scale investments, thoughtful innovation, and disciplined execution. The focus will remain on enhancing product offerings, expanding distribution networks, and deepening consumer engagement.

Despite headwinds in the broader FMCG industry during the latter half of FY25, the oral care category continues to display significant growth potential. The Indian toothpaste market alone is valued at approximately Rs 18,000 crore. While competitors like Hindustan Unilever experienced a 3% decline in turnover in personal care, Colgate’s targeted strategies have allowed it to maintain and grow its market share.

Commitment to Sustainability

Sustainability remains a cornerstone of Colgate’s mission in India. The company has embedded recyclable packaging and environmentally conscious practices across its product lines, aiming to blend affordability with ecological responsibility.

“Sustainability is non-negotiable,” Narasimhan affirmed, highlighting that all product tiers—from economy to premium—adhere to strict environmental standards.

This article is inspired by content from Storyboard18. It has been rephrased for originality. Images are credited to the original source.

Leave a Reply