Digital Marketing Powers French Economy in 2024

France’s digital marketing sector contributed €14.4 billion in direct revenue during 2024, underpinning 310,000 jobs across the nation, according to a comprehensive economic impact study by Alliance Digitale and EY. Released on December 4, 2025, the report reveals that this sector is growing five times faster than France’s overall GDP, with its momentum driven largely by advertising technology providers and platform operators.

More than 18,000 companies currently operate in the digital marketing ecosystem, reflecting a 41% increase since 2022—substantially outpacing the 16% growth seen in France’s broader economy over the same period. The findings highlight digital marketing’s evolution from an experimental tool into a core part of the nation’s economic infrastructure.

Revenue Distribution Concentrated Among Platforms

Technology platforms and digital content networks captured 36% of the sector’s revenue, amounting to €5.2 billion. These earnings came largely from search engines, social media platforms, and e-commerce marketplaces. Marketing technology (MarTech) firms brought in €5 billion, or 35% of total revenue, while consulting and creative agencies claimed €4.2 billion, accounting for 29%.

This revenue concentration mirrors wider European trends, with France ranking second in digital advertising expenditure at €11.2 billion for 2024. Major platforms now absorb around 70% of all digital ad spend, intensifying market dominance and raising industry concerns about diversification and negotiating power.

Innovation Investment Outpaces Traditional Sectors

The sector stood out for its robust commitment to innovation, investing €1.6 billion in research and development in 2024—11.5% of total revenue. This dwarfs the 3% average R&D spend seen in industries like automotive manufacturing. AdTech and MarTech companies led the way, allocating up to 16% of turnover to innovation.

“Despite economic headwinds, companies continue prioritizing R&D,” noted Yannick Cabrol, Director at EY Consulting. The push is largely driven by the need to develop artificial intelligence (AI) capabilities and adapt to evolving privacy regulations that constrain traditional targeting methods.

Employment Surges Beyond Major Cities

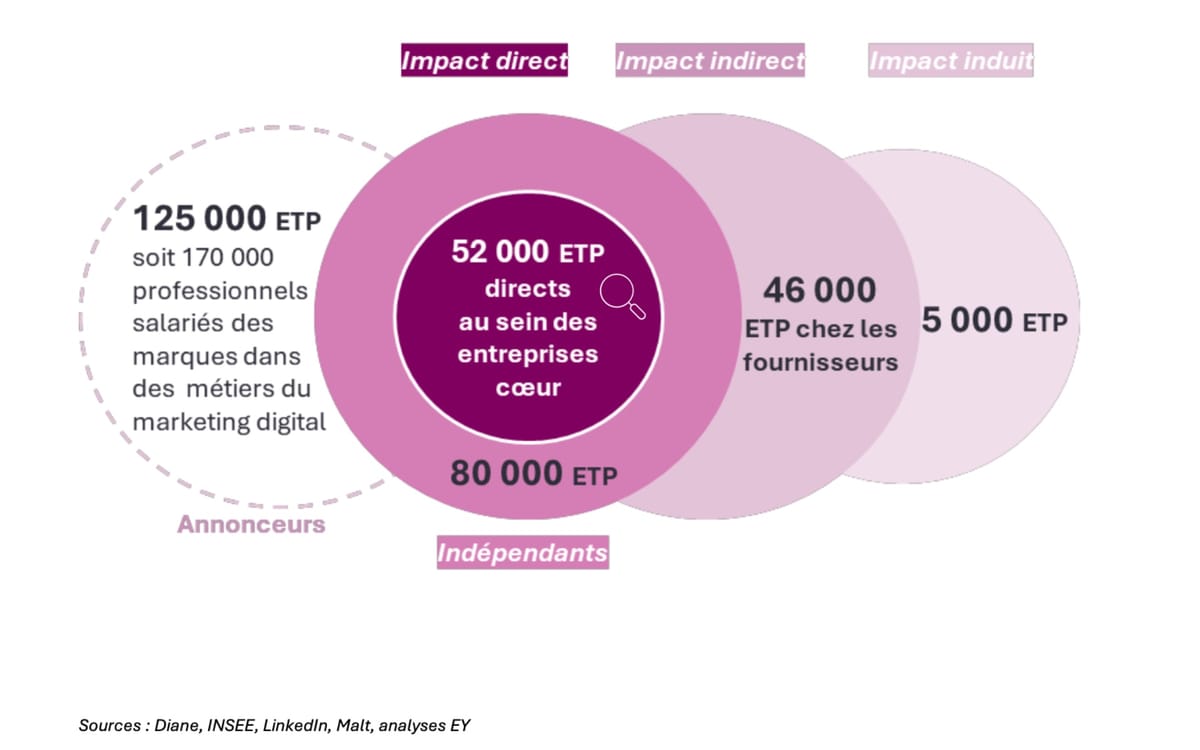

The sector directly employed 51,846 full-time professionals and indirectly supported tens of thousands more, including 80,000 freelance marketers and 170,000 in-house roles at advertiser firms. Notably, 49% of these jobs exist outside the Paris region, with cities like Lyon, Marseille, Bordeaux, Montpellier, and Nantes emerging as secondary industry hubs.

Average monthly salaries in the sector reached €3,522—about 29% higher than the national private-sector average. Technology platform employees earned the most, averaging €3,761 per month. However, gender disparities persist, with women making up only 40% of the sector’s workforce, significantly trailing other industries.

Economic Ripple Effects Reach €24.3 Billion

Beyond direct contributions, the sector generated an additional €8.9 billion in supplier revenue and €1 billion through worker consumption. Combined, the total economic output reached €24.3 billion. For every euro earned directly, an extra €1.26 was created through indirect and induced effects—outpacing other sectors like film and pharmaceuticals.

Service procurement, including legal, technical, and content production support, amplified these multiplier effects. The growth of retail media networks also expanded demand for marketing services, integrating e-commerce advertising into broader campaign strategies.

Technology Firms Drive R&D Spending

Software publishers and data measurement platforms absorbed 40% of research budgets, totaling around €640 million. In contrast, agencies focused just 5% of their revenue on innovation, emphasizing client service over proprietary tech development. AI integration was a common priority, with 82% of executives expecting generative AI to transform operations in the coming years.

AI is increasingly used for automation, content creation, and performance optimization, pushing companies to invest in data science and advanced analytics to compete for advertiser budgets.

Regulatory Pressures Reshape Strategies

Regulatory compliance emerged as the second-largest concern for companies, with 74% citing challenges from data protection laws like the GDPR and ePrivacy Directive. While these rules limit targeting precision, they have spurred innovation in consent management and first-party data strategies.

Nicolas Rieul, President of Alliance Digitale, remarked, “Regulation destroys value in the short term but recreates it over time. It has made French agencies more inventive than their European peers.”

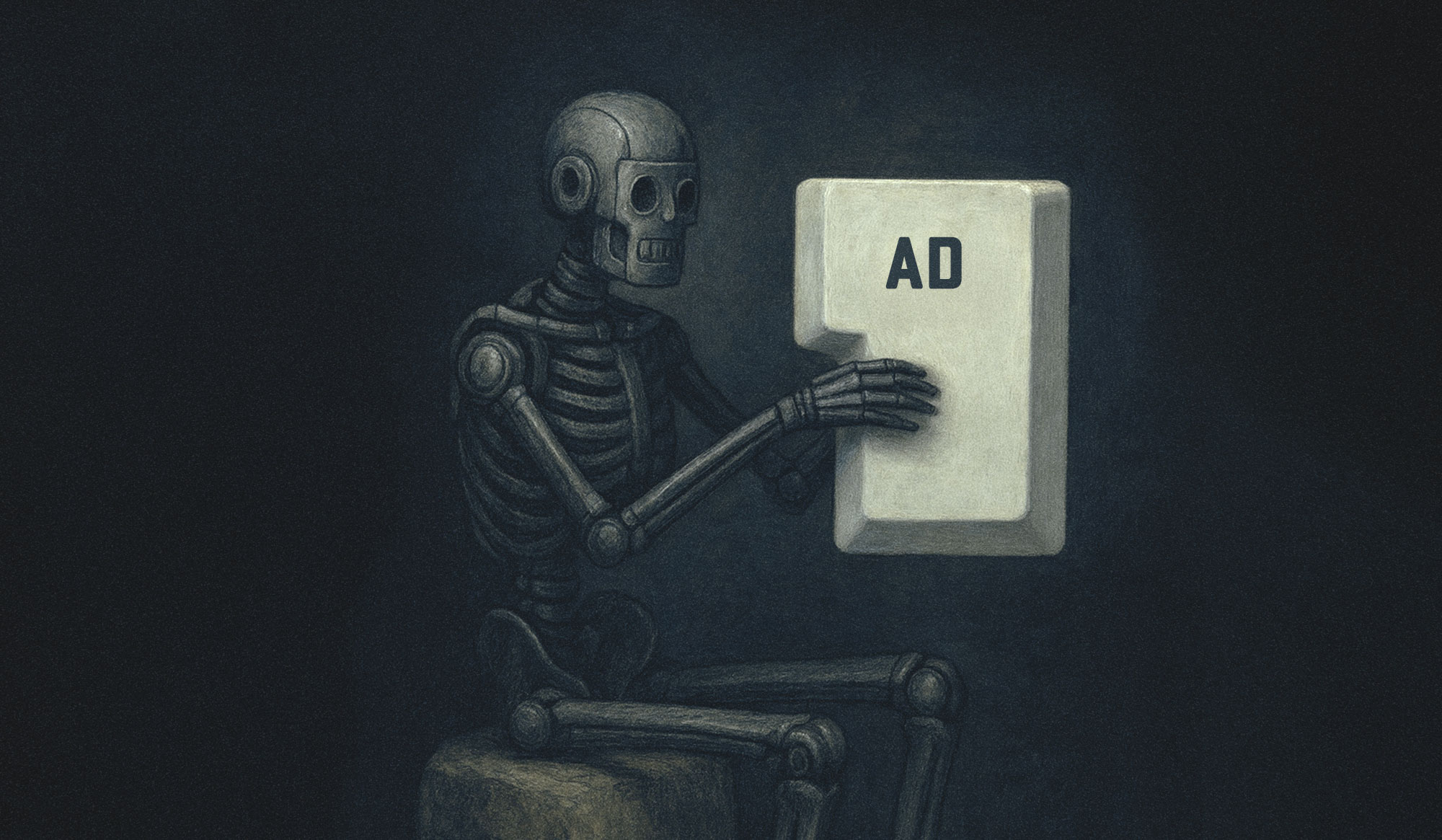

Platform Dominance Raises Strategic Risks

Executives identified platform concentration as their top strategic challenge, with 79% expressing concern. Major platforms control roughly 70% of ad distribution, limiting options and bargaining power for smaller publishers and agencies. Platform operators also retain exclusive access to user data, complicating performance measurement and attribution.

Cross-device usage and privacy restrictions have made it harder for marketers to track user behavior, pressing agencies to adapt their measurement tools and strategies.

Performance Metrics Redefine Agency Operations

Advertisers increasingly prioritize immediate returns over brand-building, with 68% focusing on performance metrics. This benefits direct-response channels like search and social media, while challenging agencies that specialize in creative strategy.

Advanced bidding systems, such as those used by EssenceMediacom France, have shown cost efficiencies of up to 7%. These systems demand new technical capabilities, prompting agencies to restructure teams and hire data specialists.

Global Expansion and Talent Gaps

International revenue hit €2.3 billion, or 17% of turnover. Technology firms led with 19% of income from exports, while agencies reported 14%. Most companies plan to expand in Europe, but only 20% intend to open foreign offices, preferring remote or partner-driven models.

Commercial and technical roles remain hiring priorities, but 50% of firms face recruitment challenges. Salary inflation hit 8.5%—well above the national average—due to fierce competition for expertise in programmatic advertising and data analysis. Offshore outsourcing is also on the rise, particularly among agencies under margin pressure.

Environmental Goals Take a Back Seat

While 71% of companies reported stronger environmental engagement than three years ago, client demand for sustainability has waned amid economic uncertainty. Still, 73% have implemented decarbonization strategies, focusing on energy use and supply chain emissions. The sector accounts for roughly 4% of France’s carbon footprint, with AI technology threatening to increase this share.

Study Methodology and Scope

The analysis was conducted between July and October 2025, combining statistical models with input from 40 executive surveys and 16 in-depth interviews. The scope expanded from the previous 2023 report following Alliance Digitale’s merger with DMA France, offering a broader view of the sector’s impact.

This article is inspired by content from Original Source. It has been rephrased for originality. Images are credited to the original source.