Meta’s AI Strategy Powers Massive Growth in Ad Revenue

Meta’s aggressive investment in artificial intelligence (AI) has paid off handsomely, with its AI-driven advertising products now generating over $60 billion in annual revenue. The tech giant reported a 26% year-over-year increase in revenue, reaching $51.24 billion in Q3 2025, beating analyst expectations and reinforcing the effectiveness of its AI-powered ad solutions.

These results were largely attributed to AI advancements that enhance user engagement on platforms like Facebook and Instagram. By refining ad-ranking algorithms and maximizing content relevance, Meta has significantly boosted advertiser performance and platform stickiness.

“After years of uncertainty, Meta has regained momentum by doing what it excels at — monetizing attention with remarkable precision,” said Jeremy Goldman, eMarketer’s senior director of briefings. “While others explore theoretical AI applications, Meta has turned AI into a profit engine.”

Advantage+ and Video Tools Fuel Adoption

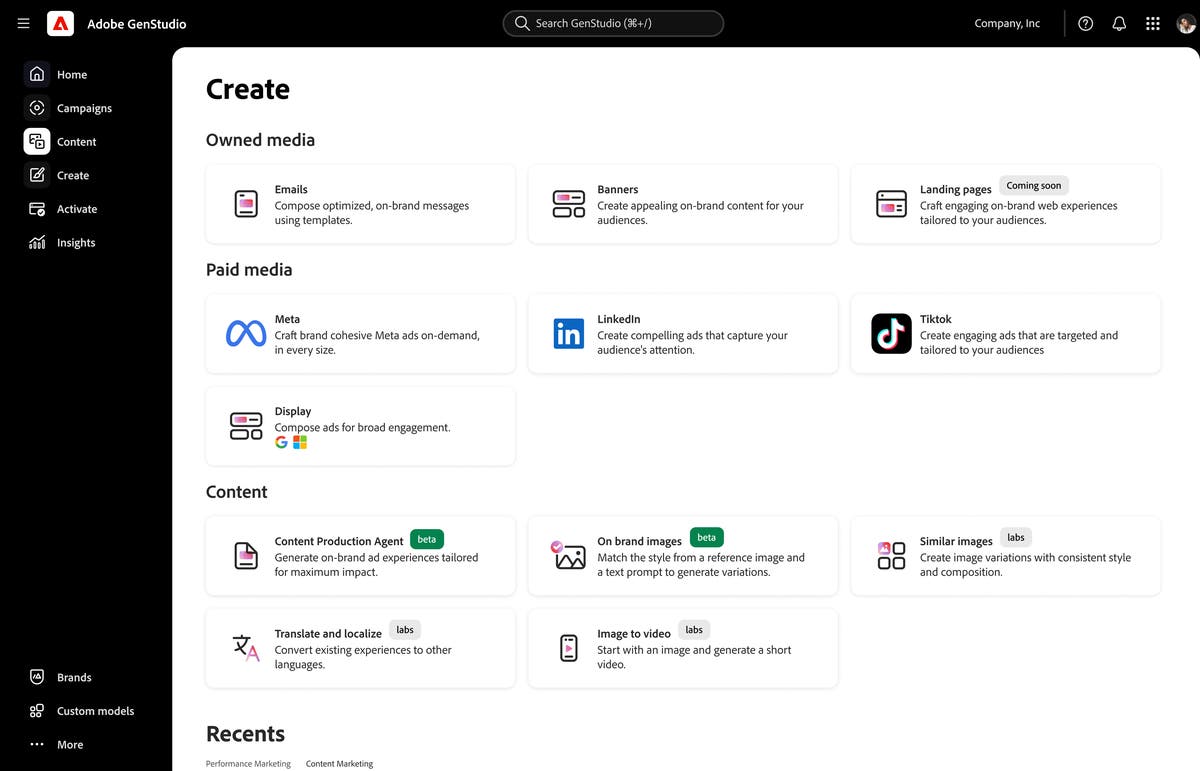

At the heart of Meta’s AI strategy is its Advantage+ suite, a set of tools that automates campaign creation, personalization, and targeting. CEO Mark Zuckerberg revealed that more brands are embracing these systems, with the number of advertisers using Meta’s video-generation tools increasing by 20% in Q2 2025.

During a call with investors, Zuckerberg outlined a future where AI handles most marketing tasks. “Marketers will simply provide campaign goals and budgets. Our AI will take care of everything else—from asset creation to precise targeting,” he said.

Other tech giants, such as Amazon, are also building AI-supported advertising ecosystems, but Meta appears to be leading the charge in commercializing these capabilities.

Reels and Changing User Behavior

Meta’s focus on short-form video, particularly Instagram Reels, is proving to be a lucrative pivot. Zuckerberg noted that Reels now boasts an annual revenue run rate of over $50 billion. This shift reflects changing user preferences, as more people engage with content from creators outside their immediate social circles.

High engagement with Reels and other video formats has driven up the average price-per-ad by 10% year over year in Q3. However, gains were partially offset by increased impressions in lower-monetized regions and formats.

Chief Financial Officer Susan Li highlighted the strong performance of Meta’s video features, noting sustained growth in user interaction and advertiser interest.

Cost of Staying Ahead in the AI Race

Despite the impressive revenue surge, Meta’s AI ambitions come with considerable financial burdens. The company revised its capital expenditure outlook for the year to between $70 billion and $72 billion, up from previous estimates that started at $66 billion. This increase reflects the high costs of AI development, including specialized talent and energy-intensive data centers.

Meta recently laid off approximately 600 employees from its AI division, signaling ongoing restructuring efforts to optimize operations. While the company boasts a deep talent pool in AI, these cuts underscore the challenges of managing such a rapidly evolving field.

Investors reacted cautiously, with Meta’s stock dipping in response to the increased spending projections.

Reality Labs and the Metaverse Struggles

While AI-driven advertising has become Meta’s crown jewel, the company’s Reality Labs division continues to be a financial drag. In Q3 2025, the unit posted a $4.4 billion loss, reflecting ongoing struggles with its virtual reality and metaverse initiatives.

Despite these setbacks, some analysts remain optimistic about Meta’s long-term trajectory. “In 2025, Meta’s greatest strength is flawless execution,” said Goldman. “Rather than chasing hype, they’ve industrialized AI relevance at scale—turning experimental tech into real-world value.”

Ironically, while the metaverse was once hailed as Meta’s future, it’s the company’s transformation into a hyper-efficient advertising powerhouse that now defines its identity.

Looking Ahead

Meta’s AI-driven advertising infrastructure has not only boosted revenues but also reshaped how marketers approach digital campaigns. As more brands tap into tools like Advantage+ and Reels, the company’s dominance in the ad space seems poised to grow—even as it navigates rising costs and internal realignments.

With federal officials hinting that a U.S.-based acquisition of TikTok could be imminent, Meta may face less competition in the short-form video space, adding to its strategic advantage.

This article is inspired by content from Original Source. It has been rephrased for originality. Images are credited to the original source.