In 2024, the U.S. digital advertising market witnessed a significant resurgence, marking a return to the robust double-digit growth that had characterized its pre-2023 performance. This resurgence was driven by a combination of improved consumer sentiment and increased optimism among marketers about the U.S. economy, leading to heightened ad spending across digital platforms.

The United States continues to hold its position as the largest digital advertising market globally, with a staggering revenue of $317 billion in 2024. Digital advertising now dominates the U.S. market, with approximately 75% of every dollar spent on advertising being allocated to digital channels. Projections indicate that internet advertising spending in the U.S. will continue to grow, potentially reaching $490 billion by 2029.

Key Players and Formats

Search advertising remains the most lucrative format within U.S. digital advertising, contributing to roughly half of the total digital ad revenue. This dominance can be attributed to Google’s leading role as the top search engine, capturing 25% of national digital ad revenue. Following Google, Facebook and Amazon are notable players, with Amazon’s share of digital ad revenue expected to increase steadily in the coming years.

Mobile advertising has emerged as a focal point for U.S. advertisers. Since 2018, when mobile ad spending surpassed desktop for the first time, the focus on mobile has only intensified. By 2024, mobile advertising accounted for 65% of total digital ad spend in the U.S. The most popular mobile ad formats are search and video, with search ads garnering nearly $82 billion in spending and video ads attracting approximately $59 billion. Mobile devices are favored over PCs due to the lower prevalence of ad blockers on smartphones and tablets.

Industry Investment Insights

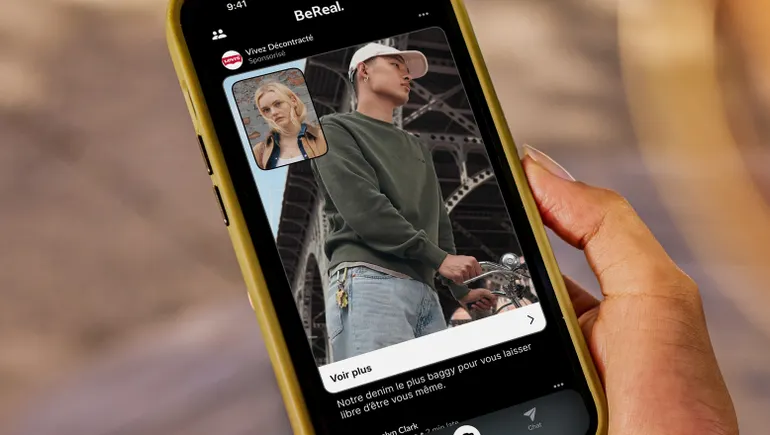

The retail industry leads in digital ad spending, contributing 15% of the total digital ad expenditure. The entertainment and financial services sectors follow closely, with 12% and 11% of the spend, respectively. This trend highlights the importance of digital platforms in reaching consumers effectively across various industries.

Consumer Attitudes Towards Digital Ads

Consumer attitudes towards digital advertising reveal a complex relationship. A significant portion of Americans, seven out of ten, are willing to share data to support advertising, recognizing its necessity for a free internet. However, four out of ten consumers express annoyance with internet advertising. Among U.S. podcast listeners, the sentiment is more favorable, with six out of ten willing to tolerate a few extra minutes of ads per show to support content continuation. Generally, consumers are most receptive to ads on shopping, news, or social media platforms.

The Path Forward

As digital advertising continues to evolve, the industry faces ongoing challenges and opportunities. Data privacy remains a critical concern, with evolving regulations necessitating strategic adaptations by advertisers. Despite these challenges, the potential for growth and innovation in digital advertising remains vast, with significant investments in mobile and search formats paving the way for continued success.

For those interested in staying updated on the latest trends and insights in digital advertising, visit martechtrend.com.

Note: This article is inspired by content from https://www.statista.com/topics/1176/online-advertising/. It has been rephrased for originality. Images are credited to the original source.

Leave a Reply